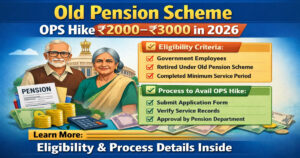

The Old Pension Scheme has once again become a major topic of discussion among government employees and pensioners. Recently, reports about a possible OPS pension hike of ₹2000–₹3000 have created strong interest nationwide. Therefore, this update is especially important for retired employees who depend heavily on monthly pension income. In 2026, several states are actively reviewing pension structures, which is why this development could bring significant financial relief.

Old Pension Scheme OPS Hike – Latest Update 2026

As per the latest updates in 2026, many state governments are considering an increase of ₹2000 to ₹3000 under the Old Pension Scheme. While the central government has not issued a uniform notification, individual states are taking independent steps. Moreover, rising inflation and cost of living have pushed governments to re-evaluate pension benefits. Consequently, pensioners under OPS may soon receive higher monthly payouts, subject to official approval.

OPS Pension Hike ₹2000–₹3000: Who Will Benefit?

Primarily, retired government employees who joined service before the introduction of NPS (New Pension Scheme) stand to benefit. In addition, family pensioners may also see an indirect advantage. However, the hike mainly targets low- and mid-level pension holders. As a result, employees from education, police, irrigation, and clerical departments are expected to gain the most under the Old Pension Scheme revision.

OPS Pension Eligibility Criteria

To qualify for the OPS pension hike, certain eligibility conditions must be fulfilled. First of all, the employee must be covered under the Old Pension Scheme, not NPS. Secondly, retirement should have occurred from a recognized government department. Moreover, the pension should be drawn through the state treasury. Therefore, contractual and private employees remain outside the scope of this benefit.

OPS Pension Documents Required

Although no fresh application is mandatory in many states, documents play a crucial role in verification. Generally, the following documents are required:

- Pension Payment Order (PPO)

- Aadhaar Card

- Bank passbook or pension account details

- Service record or retirement order

Additionally, some states may ask for a life certificate. Hence, pensioners should keep documents updated to avoid delays.

OPS Pension Application Process (Step-by-Step)

In most cases, the pension hike under the Old Pension Scheme is applied automatically. However, if manual verification is required, the process is simple:

- Visit the official state pension or treasury portal

- Log in using pension ID or PPO number

- Verify personal and bank details

- Upload required documents, if asked

- Submit and track status

As a result, approved beneficiaries will receive the revised pension directly in their bank accounts.

OPS Pension Increase: State-wise Update

Currently, states like Rajasthan, Chhattisgarh, Himachal Pradesh, Punjab, and Jharkhand are actively supporting OPS benefits. Meanwhile, other states are still evaluating financial feasibility. Therefore, the implementation timeline may vary. Nevertheless, the growing demand indicates that more states could announce hikes under the Old Pension Scheme in the coming months.

Important Things to Know Before Applying

Before expecting the pension hike, pensioners should remember a few key points. Firstly, the ₹2000–₹3000 increase is state-dependent, not nationwide yet. Secondly, official government notifications should be trusted over viral news. Moreover, keeping bank and Aadhaar details updated is essential. Finally, staying informed through official portals ensures timely benefits.

Final Note

In conclusion, the proposed OPS pension hike 2026 is a positive step toward securing the financial future of retirees. Although implementation varies by state, the Old Pension Scheme continues to remain a strong support system. Therefore, eligible pensioners should stay alert and prepared to benefit from this upcoming relief.