In today’s digital age, managing financial documents efficiently is crucial. One of the most important financial identifiers in India is the PAN card, which stands for Permanent Account Number. However, with the advent of digital services, the traditional PAN card has evolved into a more convenient form known as the E-PAN Card. In this article, we will explore what an E-PAN card is, how to apply for it online, the required documents, fees, and how to check its status. By the end, you will understand everything about E-PAN Card Apply and why it is a faster, hassle-free alternative to the physical PAN card.

What Is E-PAN Card?

An E-PAN card is a digital version of the traditional PAN card issued by the Income Tax Department of India. Unlike the physical PAN, the E-PAN is completely electronic and holds the same legal validity as its physical counterpart. In fact, the E-PAN can be downloaded instantly and is digitally signed, making it a secure and verifiable document.

Moreover, the E-PAN card contains all the essential details such as your PAN number, full name, date of birth, and photograph. Therefore, it serves all purposes that a physical PAN card does, including filing income tax returns, opening bank accounts, and conducting financial transactions.

What Is Instant E-PAN Card?

The Instant E-PAN card is a facility introduced to simplify the process of obtaining a PAN. As the name suggests, it allows applicants to receive their PAN card almost immediately after submission. In fact, it is especially beneficial for individuals who need a PAN urgently for financial transactions or legal purposes.

Additionally, the Instant E-PAN card is issued based on the Aadhaar number of the applicant. This means there is no need to submit physical documents, and the process is entirely online. Meanwhile, the digital PAN is sent directly to your registered email address in PDF format, which can be used immediately.

How to Apply For E-PAN Card Online

Applying for an E-PAN card is a simple and quick process. There are multiple ways to do this, primarily through Aadhaar-based verification or via the NSDL portal. Below, we explain both methods.

E-PAN Card Apply With Aadhaar

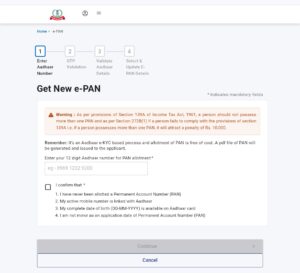

If you already have an Aadhaar number, the process becomes seamless. Here’s how you can apply for an E-PAN card using Aadhaar:

- Visit the official Income Tax e-filing portal.

- Click on the “Instant PAN through Aadhaar” option.

- Enter your Aadhaar number and the OTP sent to your registered mobile number.

- Verify your details and submit the application.

- Once submitted, the E-PAN card is generated instantly and sent to your registered email ID.

This method is extremely fast and ideal for those who want to avoid paperwork and physical submission.

NSDL E-PAN Card Apply Online

Alternatively, you can apply for an E-PAN card via the NSDL portal. This method is suitable for individuals who may not have an Aadhaar number or prefer a more traditional verification process. Follow these steps:

- Visit the NSDL PAN portal.

- Select the “Apply for PAN” option.

- Choose “Individual” as the category and fill in the required details.

- Upload scanned copies of the necessary documents.

- Pay the applicable fees online.

- Once verified, the E-PAN card is sent to your registered email address.

Meanwhile, you also have the option to request a physical PAN card along with the E-PAN for a nominal fee.

Documents Required For E-PAN Card

The documents required for E-PAN Card Apply depend on the method you choose:

With Aadhaar: No additional documents are required as your Aadhaar serves as identity, address, and date of birth proof.

Via NSDL: You must submit scanned copies of:

- Identity Proof (Passport, Voter ID, Aadhaar, Driving License)

- Address Proof (Electricity bill, Bank Statement, Passport)

- Date of Birth Proof (Birth Certificate, Passport, Aadhaar)

moreover, It is important to ensure that all scanned documents are clear and legible. Otherwise, the application may face delays.

E-PAN Card Apply Fees

The fee structure for E-PAN Card Apply is straightforward:

- For Indian residents, the fee is ₹107 (including GST).

- For foreign residents, the fee is ₹989 (including GST).

Payment can be made through multiple online modes, including net banking, credit/debit card, or UPI. Moreover, applying online ensures that you do not incur additional courier or administrative charges, making it cost-effective.

E-PAN Card Status Check

Moreover, After submitting your application, it is crucial to track the status of your E-PAN card. Fortunately, the process is fully digital and user-friendly. Here’s how you can check the status:

- Visit the NSDL PAN status portal or Income Tax e-filing website.

- Enter your acknowledgment number or PAN application reference number.

- Click on “Submit” to view the current status.

The portal will display whether your E-PAN card is under process, generated, or delivered to your email. Additionally, you can download the card immediately once it is generated.