In today’s digital-first tax ecosystem, accessing your PAN details online has become faster and more convenient than ever. E-PAN Card Download allows taxpayers to obtain a digitally signed PAN card in PDF format without waiting for a physical copy. Moreover, this facility saves time, reduces paperwork, and ensures instant availability when required for banking, KYC, or income tax filings.

What Is an E-PAN Card?

An e-PAN card is an electronic version of the Permanent Account Number issued by the Income Tax Department of India. It is provided in a secure PDF format and contains the same details as a physical PAN card. However, instead of being delivered by post, it can be downloaded instantly online.

Moreover, the e-PAN is digitally signed, which makes it legally valid for most financial and official purposes. In fact, banks, government portals, and financial institutions widely accept it for KYC and verification.

Therefore, if you need PAN details urgently, an e-PAN proves extremely useful. Additionally, it helps first-time applicants who want quick access without delays.

How to Download E-PAN Card Online

The E-PAN Card Download process is simple, secure, and user-friendly. You can download it through multiple official platforms depending on how and where you applied for your PAN.

Moreover, all methods require basic details such as Aadhaar number, PAN number, or acknowledgement ID. Therefore, keeping these details handy speeds up the process.

Additionally, ensure that your mobile number is linked with Aadhaar, as OTP verification is mandatory in most cases.

Instant E-PAN Card Download

Instant e-PAN is primarily meant for applicants who used Aadhaar-based PAN application services. This method allows you to download your e-PAN within minutes after successful verification.

However, it only works if your Aadhaar is linked with a valid mobile number. Moreover, there should be no existing PAN issued in your name.

Practical Tip:

If you applied through the instant PAN service, wait at least a few hours before attempting the download. Meanwhile, ensure you have strong internet connectivity to avoid session errors.

NSDL E-PAN Card Download

NSDL (now Protean eGov Technologies) provides a reliable platform for PAN services. If you applied for PAN or correction through NSDL, you can easily download your e-PAN.

Moreover, NSDL allows downloads using PAN number, acknowledgement number, or Aadhaar-based verification. Therefore, users get flexibility in accessing their documents.

Additionally, NSDL-generated e-PAN files are digitally signed and widely accepted across institutions.

UTI E-PAN Card Download

UTIITSL is another authorized PAN service provider. If your PAN was issued or updated via UTIITSL, you can download the e-PAN from their portal.

However, some users may experience slight delays if the PAN was issued long ago. Nevertheless, UTIITSL still provides a secure and official copy.

Helpful Insight:

If your PAN was issued before digitization, you might need to revalidate details before downloading the e-PAN.

Download E-PAN Card from Income Tax Website

The Income Tax e-Filing portal also offers a direct option for E-PAN Card Download. This method is especially helpful for taxpayers who regularly use the portal for returns and compliance.

Moreover, the portal integrates Aadhaar-based OTP verification, which ensures higher security. Therefore, unauthorized access risks remain minimal.

Additionally, downloading from the Income Tax website ensures you always receive the most updated version of your PAN data.

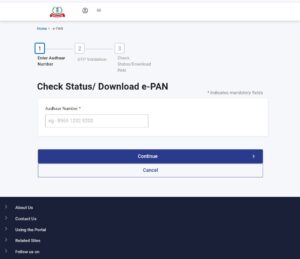

E-PAN Card Download by Aadhaar Number

Downloading an e-PAN using Aadhaar is one of the fastest methods available. However, your Aadhaar must be linked to your PAN for this option to work.

Moreover, OTP authentication is mandatory, which adds an extra layer of security. Therefore, ensure your mobile number linked with Aadhaar is active.

Step-by-Step Overview:

- Enter Aadhaar number

- Verify with OTP

- Confirm details

- Download PDF

Additionally, this method is ideal for users who do not remember their PAN number.

E-PAN Card Download by PAN Number

If you already know your PAN number, this method is straightforward and efficient. You simply need to verify your identity using date of birth or OTP.

Moreover, PAN-based downloads are useful for professionals and businesses who frequently need their PAN details. Therefore, it remains a preferred option among regular taxpayers.

Pro Tip:

Always cross-check your name and date of birth before downloading to avoid mismatches in official records.

E-PAN Card Download Password

After completing the E-PAN Card Download, you will receive a password-protected PDF file. This security measure ensures that only authorized users can access sensitive information.

Generally, the password is a combination of your date of birth and name in a predefined format. However, the exact format is usually mentioned on the download page.

Moreover, using a strong PDF reader helps avoid compatibility issues. Therefore, keep your personal details accurate to open the file smoothly.

E-PAN Card Download 2.0 – New Update Explained

The Income Tax Department introduced PAN 2.0 to enhance security, data accuracy, and digital integration. This update improves how users apply for, manage, and download PAN cards.

Moreover, PAN 2.0 focuses on faster processing, better Aadhaar linkage, and improved fraud prevention. Therefore, users experience fewer errors and quicker approvals.

Additionally, the updated system supports seamless E-PAN Card with improved server response and better document authentication. In fact, many users report faster access compared to earlier versions.