In today’s digital-first India, PAN Card Download has become one of the most searched services among taxpayers, professionals, students, and business owners.

A Permanent Account Number (PAN) is not just a tax document; rather, it is a key identity proof used across financial and legal transactions. Therefore, knowing how to download your PAN card online can save time, effort, and unnecessary paperwork.

What Is a PAN Card?

A PAN Card is a unique 10-character alphanumeric identity issued by the Income Tax Department of India. It is primarily used to track financial transactions and prevent tax evasion. However, it also serves as a widely accepted identity proof.

Moreover, a PAN card is mandatory for filing income tax returns, opening a bank account, investing in mutual funds, or purchasing high-value assets. Therefore, keeping access to your PAN card—both physical and digital—is extremely important. In fact, a downloaded e-PAN is legally valid and accepted everywhere.

How to Download PAN Card Online

The PAN Card process is completely online and user-friendly. Moreover, you can download your PAN card from multiple official platforms depending on how it was issued.

Additionally, all methods require basic verification details such as PAN number, Aadhaar number, or date of birth. Therefore, as long as your details are correct, the process takes only a few minutes. Below are the official and most trusted ways to download a PAN card online.

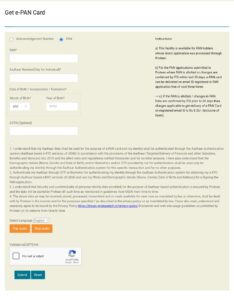

e-PAN Card Download

An e-PAN is a digitally signed electronic version of your PAN card. Moreover, it is issued instantly in many cases, especially when applied through Aadhaar-based services.

To complete e-PAN Card Download:

- Visit the official Income Tax e-PAN portal.

- Enter your Aadhaar number.

- Verify using OTP received on your Aadhaar-linked mobile number.

- Download the PDF instantly.

Therefore, this option is ideal for users who need their PAN urgently. In fact, the e-PAN PDF is password-protected and fully valid for all purposes.

NSDL PAN Card Download

If your PAN was issued via NSDL (now Protean), you can download it directly from their portal. Moreover, this method is widely used for both new and corrected PAN cards.

Steps include:

- Go to the NSDL PAN Card page.

- Enter PAN, Aadhaar, and date of birth.

- Complete OTP authentication.

- Download the PAN card PDF.

Additionally, NSDL PAN Card ensures high security and quick access. Therefore, it is a preferred choice for many applicants.

UTI PAN Card Download

UTI Infrastructure Technology and Services Limited (UTIITSL) also provides PAN-related services. However, you must ensure your PAN is registered with UTI’s database.

To proceed:

- Visit the UTIITSL PAN services portal.

- Select “Download e-PAN.”

- Enter PAN and DOB.

- Verify details and download.

Meanwhile, if your PAN is not available for download, you may need to place a request first. Therefore, checking eligibility beforehand is helpful.

Income Tax e-Filing PAN Card Download

The Income Tax e-Filing portal allows registered users to access their PAN details easily. Moreover, this method is useful if you already file returns online.

Steps:

- Log in to the income tax e-filing website.

- Go to “My Profile.”

- Select PAN details.

- Download your e-PAN.

Additionally, this option integrates PAN data with tax records. Therefore, it ensures accuracy and consistency across filings.

Duplicate PAN Card Download PDF

If your original PAN card is lost, damaged, or misplaced, you can download a duplicate PAN card PDF online. Moreover, you do not need to apply for a new PAN number.

To download:

- Use NSDL or UTI portals.

- Select “Reprint PAN Card.”

- Verify identity using Aadhaar or PAN details.

- Download the duplicate PAN card PDF.

Therefore, Duplicate PAN Card is the fastest solution in emergencies. In fact, the downloaded copy holds the same validity as the original.

PAN Card Download by Name and Date of Birth

Many users forget their PAN number. However, PAN Card Download is still possible using name and date of birth in certain cases.

First, you need to:

- Search your PAN using name and DOB on the income tax portal.

- Retrieve the PAN number.

- Proceed with the download using official portals.

Therefore, even without remembering your PAN number, recovery is simple. Moreover, keeping Aadhaar linked makes this process smoother.

PAN Card Download by Aadhaar Number

Aadhaar-based PAN Card is one of the most popular methods today. Moreover, it enables instant verification.

Steps include:

- Visit the e-PAN download portal.

- Enter Aadhaar number.

- Verify via OTP.

- Download the PAN card PDF.

Additionally, this method works only if your PAN is linked with Aadhaar. Therefore, ensure linking is completed beforehand to avoid delays.

How to Download PAN Card Without PAN Number

Downloading PAN without knowing the PAN number is possible but involves an extra step. However, the process remains fully online.

First:

- Use the “Know Your PAN” service on the income tax website.

- Enter name, DOB, and mobile number.

- Receive PAN details via SMS or email.

- Use retrieved PAN for download.

Therefore, even without the PAN number, access is not blocked. In fact, this feature is especially helpful for first-time users.

Can We Download PAN Cards Online?

Yes, PAN cards can be downloaded online easily and legally. Moreover, the Income Tax Department recognizes e-PAN as a valid document.

Additionally, digital PAN cards are accepted by banks, financial institutions, and government agencies. Therefore, you do not always need a physical card. In fact, carrying a soft copy on your phone is often sufficient.

Details Required for PAN Card Download

To complete PAN Card successfully, you generally need:

- PAN number or Aadhaar number

- Date of birth

- Mobile number linked with Aadhaar

- OTP for verification

Moreover, accurate details are crucial. Therefore, always ensure your information matches official records to avoid errors.