Applying for a PAN card or making corrections becomes much easier when you understand the correct forms and procedures. PAN Card Form Download is one of the most searched queries because millions of individuals, students, professionals, and businesses require a PAN for tax, banking, and financial purposes. Therefore, this detailed guide explains every PAN-related form, how to download them, and how to fill them correctly.

What Is PAN Card Form?

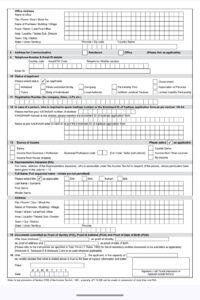

A PAN Card Form is an official application document issued by the Income Tax Department of India. It is used to apply for a new PAN card, make corrections, or submit declarations such as Form 60.

However, different PAN-related purposes require different forms. For example, Form 49A is meant for Indian citizens, while correction forms are used to update personal details. Therefore, choosing the right form is essential to avoid rejection or delays.

Moreover, PAN forms can be submitted both online and offline, depending on user convenience. In fact, most applicants prefer online submission after completing the PAN Card Form Download process.

PAN Card Form Download PDF

The PAN Card Form Download PDF option allows users to access official forms in a printable format. This is especially useful for people who prefer offline submission or assistance from agents.

Additionally, the PDF format ensures that the structure of the form remains unchanged. Therefore, users can fill accurate details without formatting issues.

Key benefits of PAN Card Form Download PDF:

- Official and government-approved format

- Can be filled manually or digitally

- Useful for offline submission

- Easy to store for records

Moreover, before printing the form, always check that it is the latest version. Otherwise, outdated forms may lead to rejection.

PAN Card Form 60 PDF Download

Form 60 is a declaration form used by individuals who do not have a PAN card but need to complete financial transactions.

However, Form 60 is not a replacement for a PAN card. Instead, it is a temporary compliance document required by banks, financial institutions, and authorities.

When is Form 60 required?

- Opening a bank account without PAN

- High-value transactions

- Property purchases

- Fixed deposit investments

Therefore, PAN Card Form Download also includes Form 60 PDF for users without PAN. Moreover, providing correct income details in Form 60 is crucial, as false information can lead to penalties.

PAN Card Form for Correction

If your PAN card has incorrect details such as name spelling, date of birth, address, or photo, you must use the PAN Card Correction Form.

However, many users mistakenly reapply for a new PAN instead of using the correction form. Therefore, always choose the correction option to save time and money.

Details you can correct:

- Name

- Father’s name

- Date of birth

- Address

- Photograph and signature

Moreover, after completing the PAN Card Form Download for correction, supporting documents must be attached. Otherwise, the request may be rejected.

PAN Card Form 49A

PAN Card Form 49A is specifically meant for Indian citizens, including individuals, HUFs, and trusts.

Additionally, this is the most commonly used form for new PAN applications. Therefore, understanding Form 49A is essential for first-time applicants.

Key features of Form 49A:

- Applicable only for Indian citizens

- Used for new PAN card application

- Available online and offline

- Requires identity, address, and DOB proof

Moreover, after completing the PAN Card Form Download for 49A, users can submit it online or send the physical form to authorized centers.

NSDL PAN Card Form

The NSDL PAN Card Form is provided through the official NSDL portal, which is one of the authorized agencies for PAN services.

However, NSDL and UTIITSL forms serve similar purposes. Still, many users prefer NSDL due to faster processing and better tracking options.

Types of NSDL PAN Card Forms:

- New PAN application

- PAN correction form

- Reprint PAN card

Therefore, completing the PAN Card Form Download from NSDL ensures authenticity and reliability. Moreover, NSDL provides acknowledgment numbers for easy tracking.

How to Fill PAN Card Form (Step-by-Step Guide)

Filling the PAN card form correctly is crucial. Otherwise, even small mistakes can cause delays or rejection.

Step 1: Choose the Correct Form

First, identify whether you need Form 49A, correction form, or Form 60. Therefore, selecting the correct option is essential.

Step 2: Enter Personal Details

Next, fill in your full name, date of birth, and gender exactly as per Aadhaar or valid ID. Moreover, consistency across documents is critical.

Step 3: Provide Contact Information

Additionally, enter your mobile number and email ID carefully. This is important because OTPs and updates are sent here.

Step 4: Fill Address Details

Then, provide your complete residential address with PIN code. However, ensure it matches your address proof.

Step 5: Upload or Attach Documents

After that, attach identity, address, and DOB proof. Therefore, clear and valid documents improve approval chances.

Step 6: Review and Submit

Finally, review all details before submission. Moreover, after completing the PAN Card Form Download, always double-check spelling and numbers.

Why PAN Card Form Download Is Important

The PAN Card Form Download process plays a vital role in India’s financial system. It allows individuals to comply with tax laws and participate in financial activities legally.

Moreover, PAN is mandatory for:

- Filing income tax returns

- Opening bank accounts

- Investing in mutual funds and shares

- Buying or selling property

Therefore, having the correct PAN form and submitting it properly ensures smooth financial operations.